LCF BloG

Quarter Four Market Recap & Deep Dive on 2023 Market Outlook

Overview

The second half of the 2022 year was mildly better than the first half. While the extreme selling in the market was subdued the overall investor sentiment didn’t improve with continued interest rate hikes and the official end of the zero interest rate policy, sustained elevation in inflation, and the looming ‘recession’ in 2023 adding headwinds to any rally the market could muster. I remain confident that there are great investment opportunities going into 2023 and will keep an aggressive stance on portfolio positions as we look to maximize returns this year.

Deeper Dive

Let’s start by looking at the current market conditions:

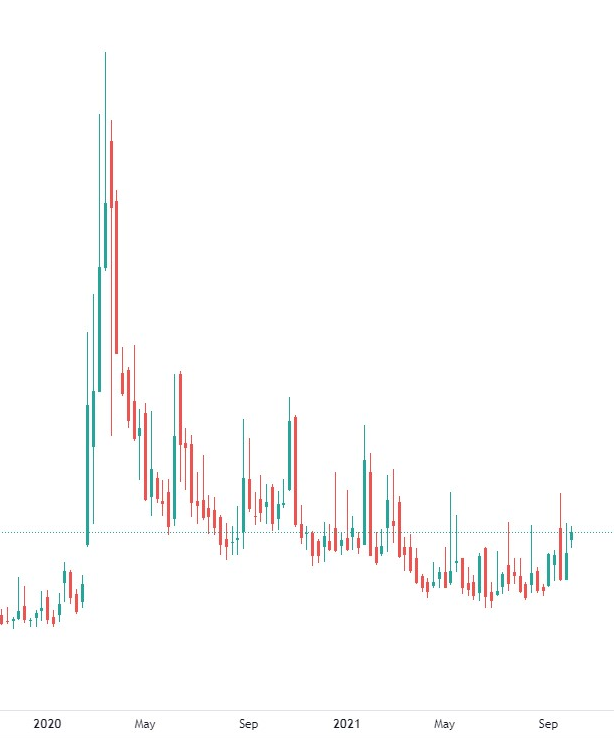

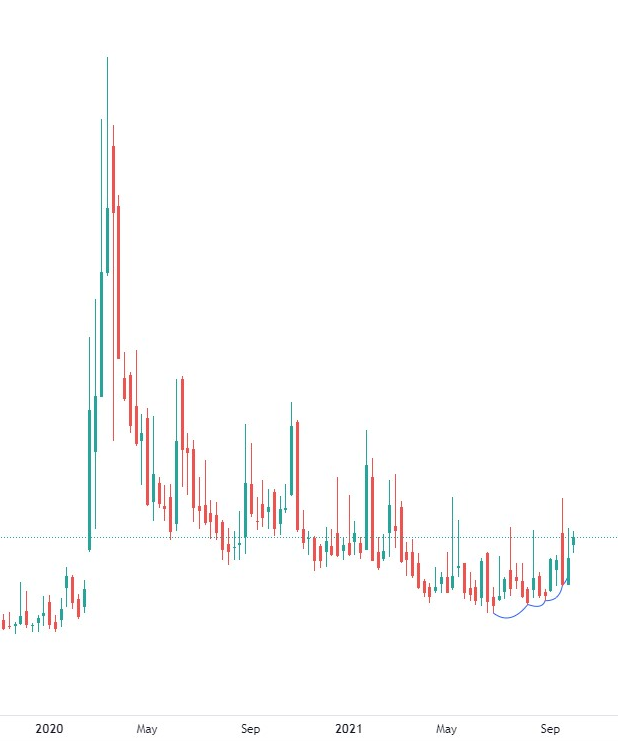

While the first half of the year was marred by extreme selling and declining prices in the market, the second half of the year moved into a chart pattern that we refer to as “sideways” or what is often called “market chop”.

You’ve likely heard me talk about the 3 directions that the markets can go in: up, down, and sideways. Everyone understand price moving up or down, but I often find it difficult to provide an example of sideways price action. Well, here it is:

While there’s lots of up and down movement, there’s a lack of definitive direction and if you look closely, you can see that after 7 months the market is back where it was mid-year. And by chopping into the end of the year, the S&P 500 and Nasdaq closed out their worst year since the 2008 Financial Crisis at -18% and -32% respectively.

A Closer look

I believe it's helpful to understand the underlying fundamentals that created this challenging investment environment. Rather than rehash the inflation (cost of goods and services) narrative that we're hearing about all too often, the real and simplest explanation for the current market condition is purely the result of the cost of money (interest rates) increasing at the fastest pace since the early 1980s.

The purpose of central banks is to help support economies. So, at the beginning of the pandemic when the Feds decided to start printing money, the intention was good, it was meant to support those employees who would lose their jobs working for companies that could not support employees working from home. However, when very few people we're out of work, the Feds support plan backfired and markets received an overwhelming influx of liquidity (cheap money) into the system.

As a result of this the trading mantra of “buying the dip” (which has served market participants well for 15 years) continued to reward investors and further condition an entire generation of market participants that things only go “up”. And this conditioning is understandable. When I jokingly ask my younger investment clients if they were concerned that their home was losing value in 2008, they respond: “uh no. I was still in high school.” So that means that anyone under the age 40 has basically spent their entire adult life (so far) only seeing one possible market condition with absolutely everything going straight up in cost and value.

None of these investors have experienced the adverse consequences of extreme inflation and tightening monetary policy and the affect that it can have on stock/commodity/home prices. And an extended period of fearful media, gloomy outlooks, and poor self-directed annual performance will likely cause them to be sidelined and miss the coming opportunity.

The outlook for 2023

On a positive note, the end of the fed's tightening cycle is insight which may present an extraordinary opportunity for low risk high probability profitable trading opportunities for those investors that are patient and know what to look for in the new year.

If you consider the benchmark interest rate on mortgage approvals, it gives an indication of where we are and what we can hopefully expect in the new year. When applying for a new mortgage, lenders will income test applicants at a rate of 4.99% (the benchmark rate). What this does is allow the Feds to raise rates all the way to that rate without homeowners defaulting on their mortgage payments.

As The Bank of Canada’s interest rate rises, we’re now approaching this benchmark. The current rate is set at 4.25% which puts the 4.99% benchmark within arm’s length now and this gives us a good indication that future rate hikes in 2023 are likely going to slow and/or stop in the near term. How do we know that? Because the BoC is pinned in a corner here. They raised rates aggressively to stave off inflation, however, if they continue to raise rates they will run a serious risk of homeowners defaulting on their mortgages (not to mention the tidal wave of defaults on homeowners that are currently underwater on their mortgage. Check out the Q2 market recap (PUT A LINK HERE) for a deeper dive into that) which puts the banks and financial institutions at risk, or they hold rates where they currently are, allow this monetary policy to permeate the economy and personal financial budgets. Their pace of increases are too high, too fast. It’s unsustainable.

If the cost of borrowing money is increasing than that should have a direct effect on consumers purchasing goods, or more simply put, people should have less money for spending on things like Christmas presents as more of their monthly budget goes to higher mortgage payments, but that’s just not the case. Look at 2022’s Black Friday sales records:

“Online shoppers spent a record $9.12 billion on Black Friday, up 2.3% compared with 2021. With inflation top of mind, U.S. consumers sought deeper discounts and flexible ways to pay, leading to an increase in buy now pay later payments.”

Instead of tightening personal budgets, people are spending money at a record rate never seen before in the past. And this is even more evident in the increase of US Credit Card Balances returning to near record highs while US Personal Savings Rate Percentages are nearing record lows.

These insights show that the tightening on monetary policy hasn’t yet been felt by households or effected household budgeting decisions. It takes time for higher rates to impact the economy and in 2023 we’ll likely begin to see the lag-effect begin to be reflected in the economic reports. A weakening economy will usher the way for lower interest rates which could further prompt the Fed to pause or even reverse future rate hikes.

Where are the opportunities?

To answer the question of where the best opportunities are for 2023, it really depends on what your savings objectives are. I’ll do my best to simplify the opportunities into these 3 different risk categories: conservative, moderate, speculative risk takers.

Conservative

If you would call yourself a conservative investor because you don’t handle market movement very well or possibly, you’re in the phase of life that is focused on capital preservation more than portfolio growth then I’ve got some good news for you. Savings accounts have suffered over the past few years from next to 0% interest rates and as rates rise, so do rates inside your savings accounts. Many financial institutions are starting to offer midrange single digit returns in short term GIC accounts. So, if you’re approaching retirement or have already been living in retirement, now might be the time to reconsider adding annuities to your portfolio for decent returns and security on a portion of your portfolio.

2. Moderate

If you’re like most and call yourself a moderate risk taker, then there’s a good chance that medium risk portfolios will perform well in 2023. With conservative holdings in mixed portfolios returning steady numbers from higher interest rates, the equity portion of portfolios will get a lot of value from portfolios with banks or mortgage backed securities. Bank stocks should show strong performance with higher interest rates along with mortgage-backed securities as committed monthly payments increase.

3. Speculative

For those looking for high growth opportunities or for those with a high-risk portion of their total portfolio (if you don’t have a portion of your portfolio that is dedicated to higher risk taking for speculative growth opportunities then connect with me today and let’s find out if the Exactitude fund is right for you) the elevated levels of volatility in the market will produce great opportunities this year. In particular, the commodities market. With the bond and DXY markets (which affects dollar pairings and precious metals) being so tightly dependant on monetary policy announcements, their trade opportunities have become limited to calendar appointments and rate announcements, however, the energy market and Nat Gas more specifically have provided many widespread market moves and could be on the cusp of entering a super cycle. The grains market is also poised to possibly make some sizeable moves in 2023. And after a year of widespread negatives in 2022, many markets are set for recovery rallies this year.

Summary

While many market conditions remain in place heading into 2023, the reasoning for our aggressive stance in the market hasn’t changed much since Q2 2022 when we initially made the change to portfolios. The continued confidence we have is that clients of Lane Cuthbert Financial avoided the mass selling that was seen in the broad markets during 2022 and that better positions us to take advantage of future opportunities.

While most retail investors are fearful to stop further losses and pain from ensuing in their self-directed portfolios, other advisors are starting to really “sell” the recession storyline, and most will be spending all their efforts recovering what they’ve lost; we will be maximizing returns because we minimized losses. I thank you for your continued support and look forward to another year of serving you and your family’s wealth accumulation goals.

I thank you for your continued support and look forward to another opportunity to serve you, and your family’s wealth accumulation goals.

If you would like to book an appointment to review your personal portfolio or discuss your savings goals in more details, please send an email to Lane@LaneCuthbert.com to schedule a time.

Quarter Two Market Recap & a Deep Dive on Current Market Conditions

In the wide array of clients that I have the privilege of working with, I find that some want as little information as possible about their investments while others want to peel apart my brain layer by layer to know exactly how I see the current market conditions. In an attempt to appeal to as many different learning styles as possible I am going to start implementing an “overview” header on all market updates where I will do my best to summarize the newsletter in one (run-on) paragraph so that those who want just the highlights can get all they need to know in under 60 seconds. And for those that want more information, beneath the overview I will be going into greater detail about current market conditions and the factors that go into our market assessments.

Overview

The first half of this year has been brutal for markets. Huge sell offs, rising interest rates, soaring inflation, and a looming recession etc. The good news, we were in a conservative position, so Lane Cuthbert Financial client portfolios were immune to the losses. I believe we’ve seen a temporary bottom to the selling as media has caused a peak in investor fears (among some other factors), so we’ve adjusted portfolios to take an aggressive position for the remainder of the year to catch some gains.

Deeper Dive

Let start by looking at the current market picture:

As you can see, the first half of 2022 has been marred by extreme selling and declining prices in the market. In fact, the selloff is worse than what was seen during the COVID drop. It’s a bit deceiving but this 2022 decline has been a drop of about -23%,

and while the COVID drop measured -33%

it appears in numbers that the COVID drop was worse but that’s because the percentages are measured against the market’s value. Since the market rallied so aggressively over the past 2 years, it appears like this selloff isn’t as bad as the last one, however, if we measure the two selloffs side by side you can see that this recent drop in the market has exceeded the COVID fall.

So, what’s the significance of going into this great of detail trying to measure these 2 selloffs? Well, this is the foundation to the deciding factors that has helped support the decision we’ve made to take a more aggressive stance in portfolios.

One of the factors that we considered is that after the COVID selloff, the market rallied almost +73% to finish out the year +15.5%.

Since we had client portfolios in a conservative position, Lane Cuthbert Financial clients were immune to the market selloffs and felt only a small portion of declines in 2022 relative to the markets selling which means that by expecting a strong market rally for the remainder of the year we have very little lost ground to make up which should translate to strong portfolio returns for clients. Conservatively, if the S&P500 rallied so that the annual return for 2022 was 0%, that would be roughly a +30% rally from the current market location.

The next major factor that we considered is the measure of fear in the market. This is a picture of the VIX which is commonly referred to as the “fear index”. The higher the price on the VIX, the higher the fear is among investors.

Historically the VIX has a few major “resistance” prices, meaning that when the price of the VIX hits either $35ish or $50ish it has a major reversal in price and the market rallies.

Now if you look closely at that picture, you can see that at all the arrows the price of the VIX quickly touches those resistance prices in a single touch and then falls away quickly causing a sharp reversal in fear and the market rallies.

This is where things get a little interesting. If we zoom in on the past 6 months, you can see that the VIX has touched the $35ish mark every single month for the past 7 months in a row.

This doesn’t feel that ground-breaking considering every single social media outlet and news headline seems to be spouting out new scarier headlines every day! If we consider this from an order flow perspective however, it reveals a lot more than you’d think.

Remember that the stock market is a zero-sum game, so when someone is buying another person is selling and vice versa when someone is selling then someone else is buying. Since banks and institutions are the largest players in the game with the deepest pockets, it can be said they place the largest buy and sell orders in the market and in order for them to get their entire desired position filled they have to have all other market participants on the opposite side of their trade. By keeping fear at a high level for an extended period of time, the psychological toll that has been taken on retail investors has set in and begun to change their mindset about the market.

The rally cry of all retail investors last year was “BUY THE DIP!” as they were treated to exceptional market rallies after every little pull back in the indexes. But now in 2022, every single month for 7 months in a row, every dip in the market has led to further selling and every market rally has been short and bittersweet as a new low of selling for the year is created. Retail investors are scared of the future due to headlines about rising interest rates, looming recession, soaring inflation and they’ve now been conditioned that every market rally is met with more selling. So, if retail investors fear a worse future and are selling to stop further losses then who’s buying from them? It’s not other scared retail investors…it’s banks and institutions because for them to get their entire desired position filled, they need to herd everyone else onto the other side of their trade.

The last time the market saw multiple price touches at one of these key resistance price levels was in 2007 prior to the 2008 financial crisis.

This acts as a further confirmation that we believe will lead to a strong second half to the year…after that, we’ll likely need to protect ourselves from the downside risk again but we’ll cross that bridge when the time comes.

The last consideration we looked at was interest rates. This might seem redundant for those of you who have heard me discuss interest rates before but for those who have not let me briefly discuss the purpose of interest rates. Interest rates, being controlled by the Federal Banks (Fed Reserve and Bank of Canada in North America), are designed to be used as a market controlling tool. The idea being that when the economy is strong, the Federal banks should be raising rates to take advantage of the strong economy, collect higher interest on the money they’ve lent out during a time when the work is good and profits are comfortable, and most importantly cool off the market to stop a “bubble” from forming. And it works the other way as well, when the economy is suffering, they lower rates which stimulates economic activity by encouraging people to buy a home (since the monthly cost is reduced, or buyers qualify for higher borrowing amounts) or borrow money to invest in their own business or start a new business which results in the economy being spurred on once more and decrease the chances of a recession from occurring in the market.

Now that you understand interest rates it’s easier to understand the issue we’ve run into, which is that the Fed Reserve and the Bank of Canada have pinned themselves into a corner. Look at this:

This is a graph that follows the US Fed Funds Rate. In 2009, as part of the quantitative easing program to help recovery after the financial crisis of 08’, central banks cut rates to 0.25% and the economy recovered…but then they didn’t raised rates for 6 years. Over that 6-year period the market rallied 216.5%!! In that strong economic environment, the Fed’s failed to raise rates which meant they lost their ability to use interest rates as a tool to stimulate the economy if another downturn was to occur. And while they did raise rates from 2016-2019, it was less than half of the pre-financial crisis interest rate levels and left rates at historic lows, so when COVID hit they didn’t really have anywhere to go but back to 0.25%.

The issue with next to 0% interest rates is that it (coupled with easy access to money) leads to increased inflation rates. Which is exactly what the numbers showed as inflation rates soared to almost 10% and levels not seen in 30-40 years. That leaves the Fed Reserve with two choices to lower inflation rates. The first is to reduce their balance sheet through quantitative tightening (stop printing money) and the second is to raise interest rates. While we haven’t seen them use their common sense in reducing the rate at which they print money, the central banks have chosen to take an aggressive stance to fight inflation by increasing interest rates in leaps and bounds.

Notice the stair stepping pattern from 2016-2019. Those are sustainable achievable, DIGESTIBLE interest rate increases because every small increase allows the general public to adjust their budget as the cost of their loans and borrowed money increases (think variable rate mortgages). Now look at how steep the rate increase curve has been since the beginning of 2022. Crazy sharp! Like almost 90 degrees! This crazy adjustment has been harsh to the people, but I believe it has been for a strategic purpose. Anyone in any sort of variable rate loan situation has seen a big increase in their monthly cost of borrowing which begs the question: is variable rate or fixed rate mortgage better?

For many years the variable rate mortgage has benefited anyone who’s taken advantage of it but now with all the headlines talking about the increase in fear for further interest rate hikes to curb the “out of control inflation” situation, it leaves a lot of homeowners thinking that locking into a fixed rate mortgage would be best to protect themselves against further interest rate hikes. We call the difference between the fixed rate mortgage cost and the variable rate mortgage cost the fixed/variable spread. Pre-COVID the fixed/variable spread was tight with the fixed rate having only slightly higher rates. If we look at the fixed/variable spread today, it’s a huge chasm with fixed rates being much higher than variable rates.

I personally believe that this has been the plan all along. You see, during the pandemic home prices rose like CRAZY (I don’t need to tell you, you live in Vancouver). Many homeowners stretched themselves to get into properties that were soaring in cost and that worked alright since the monthly cost for the properties was affordable at interest rates of 0.25%, but now that rates have increased to pre-pandemic levels, a RECORD number of homeowners have now transitioned into fixed rate mortgages vs variable rate mortgages. Homeowners are locking in higher monthly payments to protect themselves against the possibility of future rate hikes, but since the fixed/variable spread is so huge right now banks are collecting a humongous pay day and have resurrected their fat cash cow. Every month, homeowners are making massive payments on a record amount of debt at historically high interest rates and now banks are stuck in a real awkward spot.

Single detached home values have seen a decrease of 25-30% since the beginning of the year and the start of the increase in interest rates. Let’s use a $2,000,000 home as an example. Say that a family stretched themselves to purchase this house. In BC, the required minimum down payment on a $2,000,000 home would be $275,000 (not including realtor fees and closing costs). If this family put down the minimum down payment, they would be looking at a mortgage of $1,725,000. When your home is worth $2mil and mortgage is $1.725mil that’s ok, but home prices have decreased, so potentially this home isn’t worth $2mil anymore, say it’s only worth $1,700,000.

With the increase in interest rates, late-comer homeowners are right on the verge of being “underwater” on their mortgage, that is, the value of their mortgage is worth more than their home. Maybe they’re thinking “we don’t care because we plan on being in this home ‘long-term’ so the value will come back before we sell.” And they would be right to think that, however, the last time that we saw homeowners go underwater on their mortgages was back in the financial crisis of 2008. What started out as being only slightly underwater turned out to be severely underwater, and what might only be a few over-levered or multi-property owners selling their home (or worse, foreclosing/defaulting) quickly turns into a tidal wave of homeowners selling. Even though people plan on staying in their home long-term at some point (when homes have lost enough value) homeowners are left asking themselves: “why would I continue to pay a $1,725,000 million dollar mortgage when my home is only worth $1,000,000?”

This scenario puts the central banks in an awkward spot. They’ve been raising rates to fight inflation but in doing so they’ve put a large portion of the population on the ropes by pushing them to the cliff edge of burying people underwater on their largest financial asset. If Fed’s continue to raise rates they run the risk of toppling the first domino and repeating a global financial crisis and a housing crash. This leads me to believe that the central banks are close to parking interest rates where they are (at least until the public has a chance to digest the rising cost and/or pay their mortgage down some more). Since they were able to create a large spread between their fixed/variable mortgages, they’re happily going to collect big pay days from homeowners concerned about higher rates when the reality is they can’t raise rates any further without dire, global, consequences.

If you’ve read this far, kudos. I hope that these insights have been valuable for you and shed some light on current market conditions without all the noise of news headlines. If you’ve been working with me for any length of time you’ve likely heard me refer to our investing method as a sailboat. When the conditions are right, we put out more of the sail to capture greater gains and returns, and when conditions aren’t right (to protect capital) we make sure that we don’t have too much sail out to avoid breaking the mast.

In May 2022, we finally…after a few long years, opened up the sails from an ultra-conservative position to a very aggressive position.

We did this for a few reasons. As mentioned above, but also because we were in an ultra-conservative position, our portfolios were immune to the isolated market sell-offs. What I mean is, while the index averages have sold off, they haven’t sold off as much as the individual underlying assets. Let me give you an example. In the Nasdaq 100, there are a group of stocks referred to as the FAANGS, that is, Facebook, Apple, Amazon, Netflix, Google, Starbucks. This group is often associated together since they are listed on both the S&P500 as some of the largest companies (and therefore have the most impact on the market) and also listed on the Nasdaq as being tech sector companies (also having a large impact on that market). While the Nasdaq saw a decline of -32% the FAANGS saw declines of -54, -40, -27, -73, -29, -41 respectively. The largest companies that have the greatest impact on the indexes fell significantly further than the index averages. So while the market might appear that is still has room to the downside, the underlying assets have already seen their major sell-offs.

Since the portfolios that we invest in, are invested in these companies we were able to avoid the market sell off and severe declines of these individual companies. And since we want to be buying low and selling high, the indexes might not look like they’ve sold off as much as their parts, but beneath the surface these companies are price levels not seen since the early 2000’s and so for that reason we’re making an aggressive adjustment to get on the same side of the trades as the banks and institutions to continue looking for low risk, high probability, profitable trading opportunities. This usually requires us to go against our human nature. To be greedy when others are fearful, and fearful when others are greedy. It’s going to be a great close to the year!

I thank you for your continued support and look forward to another opportunity to serve you, and your family’s wealth accumulation goals.

If you would like to book an appointment to review your personal portfolio or discuss your portfolio in more detail, please send an email to Lane@LaneCuthbert.com to schedule a time.

Quarter Four Recap & 2022 Opportunities

Hello investors,

Firstly, let me thank you for your patience in getting this market recap sent out. Instead of kicking off the New Year with a bang, goal setting and checking in with clients about their financial objectives for the year, it felt like I really stumbled into the New Year by testing positive for Omicron and spending about 5 days bed-bound and a week of slow recovery. What’s that old saying; “the best time to get started was yesterday, the next best time is today.” So, with that behind me, I’m looking to kick off the rest of the year right and that starts with a recap of the markets and an outlook for the financial landscape in 2022.

Q4 RECAP

Quarter 4, 2021 saw the equity markets continue their unprecedented rally from October through December. At Lane Cuthbert Financial we remained in a conservative position on portfolios with an expectation that the markets would have a strong pull back. They did not. Which is wild because that brought the total return of the S&P 500 for 2021 to approximately 27%! Absolutely insane!

If you recall the annual return of the S&P 500 in 2020 (the year where the mascot was a dumpster on fire) was 16.7%. In a year where businesses were suffering, operating at less than 25% of their capacity, with travel restrictions decimating the tourism industry, no air travel, no cruises, the market responded by giving 2x the annual average return. And now again in 2021, headlines will tote that the strong returns were due to the “great reopening”, but the economy only ‘reopened’ for like 2 months…during the summer before Omicron showed up in the Fall and locked many sectors back down.

These returns continue to be unprecedented and unwarranted. For the S&P 500 to return more than 3x its annual average while the economy is merely a shadow of its former self must be driven by alternative factors. Put simply, the government’s quantitative easing program and low interest rate environment has only served to throw gasoline on the dangerous fire.

Since the instigation of the government’s aggressive QE program of buying $120 BILLION dollars PER MONTH in bonds and basically 0% interest rates over the past 26 months, the S&P has rallied over 121%. The last 2 times the market has seen this angle of ascent and these rates of return was in the 90’s leading up the dotcom bust and in 06’/07’ leading up to the financial crisis of 2008.

Admittedly, we did not get the returns in 2021 that our clients expect to see but we also didn’t expect governments to keep interest rates this low for this long. Remember when they said the pandemic would be over in 3 months…23 months ago…

With that said, I don’t know if we’ll see a 2008 style financial crisis “crash” when government’s start tapering their bond buying but the risk certainly still remains to the downside, considering the market has now rallied over 613% since the last recession and the government is taking assertive action against inflation.

My expectation of a rate hike having adverse effects of a recessive move in the market could lead to 2 different places where we intend to make a shift from a conservative position to a more aggressive opportunity buyer of equities. The first would be a ‘technical support level’ which to be reached would require an almost 30% drop in the equity markets. The other very real possibility is that the market retests the COVID low from 2020. To get there the broad market would need to fall 50%.

Oppourtunity

Our strategy hasn’t changed but the conditions in the market certainly have. Up until this point we’ve remained in an ultra-conservative position in portfolio’s concerned over unexpected market corrections and while that still remains true for North American Markets, an opportunity has presented itself as market conditions have changed.

The Fed chair Jerome Powell has begun to reveal his hand and future decision-making process. Originally, the government had mentioned that it would taper its bond buying once inflation hit 2%, but every time they talked about taking action their timeline was vague and misleading. In Q4 2021 inflation spiked around 9.6% (real rate). The Fed’s have begun to lose control of their inflationary targets and are being forced to take action to curb inflation.

At the last FOMC meeting the Feds committed to 3 rate hikes in 2022 and 2 or 3 rate hikes in 2023 along with a reduction until ceased on their bond buying program. We’ve now been told an action and a timeline. With that clarity of information there are a few areas of opportunity that we’ll be taking advantage of:

Precious metals:

I know how touchy the crypto crowd can get with negative comments, so prepare yourself. Avid Bitcoin followers will tell you that Bitcoin has replaced gold as the digital ‘safe haven’ to protect investor assets. However, if you look over the past 10 years, Bitcoin has seen a surge of over 1,259,540% (that’s 125,954% per year) growth, meanwhile, gold has had a measly 8% (0.8% per year).

In high inflationary environments, precious metals have historically acted as a safe haven to protect against the erosion of inflation. Contrary to the Bitcoin (which has over-inflated itself) I believe that gold’s true value has been subtly forgotten and that we’ll enter back into a super cycle of growth on precious metals as investor realize that cryptocurrencies lack physical attributes and as the government takes aggressive steps to fight inflation.

2. Banking sector

Banks make money through multiple streams of revenue; however, their main pillar of income generation is through lending. In a flat or inverted yield curve environment, banks struggle to make profits borrowing at flat or high short term rate and lend money at lower rates long term. But in an increasing interest rate environment, this steepens the yield curve and allows banks to get back to the bread-and-butter income source: borrowing short term for low rates and lending out money long term at higher rates (think 30 year mortgages). If interest rates are basically at 0%, where is the only place that we can go from here? (It’s a trick question because technically we could go to negative interest rates, but I highly doubt we’ll do that in Canada, and no other country that has done negative rates has been successful with it.) Right, so the only place we can go on rates from here is up. And when rates rise, banks will see their staple profits return.

3. Asia markets

Warren Buffet’s most famous quote is to buy low and sell high. The Asia market saw the same growth that the rest of the world enjoyed during the beginning of the pandemic, however, they took a different course of action in Q3 2021 by surprising their economic landscape with severe rule changes and ‘forcing a crash’ on their markets.

A stark contrast to the S&P market. I believe what the Chinese government is doing is attempting to create an environment that is appealing for investors looking for new opportunities. If the S&P is at record highs with a potential ‘taper tantrum’ on the horizon, large institutional investors may be looking to sell out of their North American equity positions and move most of their assets into the Asian markets.

Also, when the US government had a very accommodative stance the S&P rallied 121%; the Chinese government has made announcements that it will take an accommodative stance to support its economy which I believe will provide more upside opportunity in portfolios in 2022.

As if this needs to be said, but this pandemic has been long and tediously dragged out. And while I firmly believe that an ultra-conservative position was most prudent in protecting my client’s assets, I have not been satisfied with the returns that we’ve generated in your accounts. I am, however, optimistic that these coming changes that we’ll begin to see in 2022 have presented the opportunities we look for that provide low risk, high probability for profitable investments in our client’s portfolios.

I thank you for your continued support and look forward to another opportunity to serve you, and your family’s wealth accumulation goals.

If you would like to book an appointment to review your personal portfolio or discuss your portfolio in more detail, please send an email to Lane@LaneCuthbert.com to schedule a time.

Quarter Three Market Recap

Hello investors,

Grab your pumpkin spiced everything Fall is upon us and it’s time for Q3 market update. We’ve come to an interesting place in the market and a real crossroads of what comes next. Let’s take a look:

Have you heard the term “dog days of summer”? It’s actually a stock market term and it refers to the summer months when the bank, hedge fund, and deep pocket investors go on summer vacation which results in little market activity. Well, this year they must have stayed close to home because June, July, and August saw an increase of 10.24% which sets the stage for the odd place we’ve arrived. From the COVID low to August’s high, the S&P has now rallied 109.27%!!! I know it can be hard to keep things in perspective but just to be clear…that’s NUTS!

Now this is where things get interesting. September saw a ‘red candle’ pull back which took back all of August and July’s gains.

What’s interesting about this is 1) just how relentless this market rally has been. The last time we had a red candle that took back any gains in the market was 12 months ago, in September 2020. That’s 12 months of positive gains…again, INSANE. And 2) the seasonality of the move. See the formation of September 2020 and how it exactly resembles September 2021:

There are people who will say that traditionally September is a “weak” time in the market which is why there was a market pull back. By now you’ve no doubt heard me talk about who’s on the “other side” of a trade. If the mass market is under the impression that this is a standard September pull back and plan on “buying the dip” it would be a great time for the big institutions to be selling while all these enthusiastic buyers are buying. If a market rally was truly to occur then it would be confirmed by investors having a low index of fear, but the tides are turning and that’s not the case. This is a look at the VIX, the fear index:

The fear of market participants has been steadily declining since the peak of COVID, but in June this summer something changed. It’s slight and subtle but it’s there, and it looks like this:

Now it may not look like much but for the past 4 months the VIX index has been making what we refer to as “higher lows” which is an indication of a “durable bottom” meaning that there is a confirmation that regardless of the market rallying an increasing number of the market makers are holding and increasing their hedging positions and their concerns of a major market pull back is increasing.

These are some of the signs that we’ve been looking for because it means that sooner than later there will be an emotional draw back and panic selling which will create great buying opportunities. The kind of opportunities we’ve been PATIENTLY waiting for!

WHERE DO WE GO FROM HERE?

If you review my previous market updates, I’ve been talking about the QE program that the government has been committed to has contributed to this market rally along with interest rate cuts. Throughout COVID the Federal Reserve chair, Jerome Powell, has said that the US Government will stop printing money, stop buying bonds, and raise interest rates once inflation hits 2%. Well…

Here is the month over month inflation percentages dating back to 2001. In August 2021 inflation was at 5.3%, and not to raise any alarms but the last time that inflation was this high was just a few months before the 2008 financial crash which started in November 2008. The federal reserve has chosen to ignore these numbers calling inflation “transitory” meaning they believe it will just magically disappear and they’ve continued with their low interest rates and bond buying program.

These decisions have handicapped the federal reserve’s power as they’ll now have a difficult and delicate task of unwinding this runaway market without creating a “taper tantrum” of panicky selling that could occur if the feds ever decide to taper their QE program.

OPPORTUNITY

Our strategy hasn’t changed but the conditions in the market certainly have. Up until this point we’ve remained in an ultra-conservative position in portfolio’s concerned over unexpected market corrections and while that still remains true for North American Markets, an opportunity has presented itself as market conditions have changed in Asia. In Q4 we will be making a shift to portfolios to increase exposure to the Asia markets, in particular, the China A50 (China’s equivalent to the S&P500). China has taken a very different approach to their markets compared to the US. China made legislative changes to several different sectors in their market and almost ‘forced a crash’ on their market. While the S&P has been up 80-90% over the past 8 months, the China A50 has been down -30% and seeing as we want to buy low and sell high, China has created a brilliant opportunity for all those North American investors who are looking to lock in their profits and sell high, to transition their wealth into the Asia markets and buy low. It won’t be a big position but I believe as we see the federal reserve’s decisions play out in the final months of the year in America we’ll begin to see a shift into the Asia markets which should provide some positive return opportunities for investors.

If you would like to book an appointment to review your personal portfolio or discuss your portfolio in more detail, please send an email to Lane@LaneCuthbert.com to schedule a time.