March MADNESS - Quarter One Market Recap 2023

After an abysmal 2022 and the worst returns in the S&P 500 since the 2008 financial crisis, 2023 has kicked off the year with a strong start despite the market mayhem seen in March. We saw a banking crisis in March, continued 5-6% inflation, and a Fed reserve that is committed to continued quantitative tightening while simultaneously printing more money and undoing their inflation-reducing efforts from 2022. Despite all that, the market rallied (as we expected). We will continue to stay the course with ‘open sails’ capturing upside growth; however, as we get nearer to the areas that we want to reign the sails in and protect capital, we could see a shift in Q2, 2023 to protecting client assets and investments.

Let’s take a look at the current market conditions:

After the relentless selling of 2022, Q1 of 2023 showed some strength and recovery which was our expectation and has helped to start 2023 with strong returns in client portfolios. As interest rate increases approach their peak (for the time being) and the effects of quantitative tightening begin to be seen in the economy the market has responded positively. In terms of price action, a closer look at the past few months we can see that the broad indexes are still trading inside of a tight range which happens to also be inside of a broader range as seen here:

The highlighted area is the recent tight range, while the orange lines are the outside of the broad range. In less market jargon speak, range trading refers to ‘sideways’ price action, so this recent price action of tight range trading tells us that market participants are uncertain of the future, which leads to a deadlock between the bears and bulls and the result is that very little direction gets established, as a result, we just go sideways.

Sideways price action is an indication of uncertainty for the future and since the indexes are forward-looking (meaning they react to future market conditions in the present), the market is unsure of what comes next. And understandably so.

QUANTITATIVE TIGHTENING

Throughout the pandemic, the central banks printed record amounts of money while keeping interest rates low, which flooded the economy with money and ultimately led to double-digit inflation. We’ve been talking about this for a year and a half, you get it.

Then in 2022, the Fed’s start talking about quantitative tightening, which means raising interest rates and reducing the amount of money in the economy, and that’s what they did. they raised rates, inflation came down and so did the Fed’s balance sheet. BUT, when they were doing the right thing and (albeit painfully for everyone) moving in the right direction for long-term economic health, we suddenly had a banking crisis on our hands with the collapse of SVB bank.

BANKING “CRISIS”

Now, before panic sets in and we all have flashbacks of 2008, let’s be clear this is NOT a repeat of 2008. Mortgages are the bread and butter for banks, so a real 2008 bank crisis would be this: during the pandemic when rates were next to 0%, everyone gets a variable rate mortgage on a real expensive house, then in 2022 as rates increase and people can no longer afford to make their mortgage payments people start defaulting on their mortgages, hand their keys to the bank and walk away from their home leaving the bank with a lot of properties and no cash flow…sounds bad right?!?

That is NOT what happened here. Banks rarely have money sitting idle in their vaults, instead the often do a form of what is called fractional lending and investing to generate a return on the assets held in their care. For Silicon Valley Investment Bank, they made some bad investments…like really really bad…and then they didn’t have any assigned staff to assess their investments and rank them as “bad”…so when interest rates started rising they found themselves in a negative position in their investments. That’s when a ‘run on the bank’ occurred.

A run on the bank used to not be a concern back when we used the gold standard, because for every piece of paper money in circulation there was a physical piece of gold in a vault somewhere that backed up that paper money. When we moved away from the gold standard the concern for a run on the bank became a real reality with the worry being that banks often have only a fraction of the physical cash necessary for all of their account holders, so if everyone at a certain branch decided to withdraw their money all on the same day at the same time the bank would have a difficult time being able to provide all those clients with cash which could result in them needing to liquidate large amounts of bank investments at significant losses…which is what occurred at SVB.

So there is no real threat to the banking system, just a few hundred of the largest account holders making withdrawals simultaneously. Well, that’s not how the Fed saw it. So the Fed’s, out of fear of a banking crisis, created an emergency fund of $392 billion dollars and in a matter of a few weeks added back 60% of their balance sheet in debt that they had reduced in the previous 11 months.

And wouldn’t you know it, the second that the Fed’s bailed out SVB, other banks started coming forward looking for bailouts from their bad investments as well and when money is easy to access the market responds which is why the indexes had a strong rally.

A TALE OF TWO SIDES

If the price action has been so uncertain recently then there’s a case to be made for both an rise in the market price and a fall in market price. I’ll do my best to lay out a quick case for each side and then give my insights into portfolio decisions going into Q2 2023.

DA BEARS

The case for the downside in the market is pretty straight forward. If the Fed’s continue to raise interest rates and remain hellbent on reducing inflation to their targeted 2% then we could very likely see an actual REAL bank crisis on our hands. Since any homeowner who put the minimum downpayment on their property in the past 3 years is currently underwater on their mortgage, if rates continue to rise there would come a time when homeowners throw in the towel and start handing their keys to the bank.

While I highly doubt that the Fed is in a hurry to see that happen, there has been a really interesting storyline that has supported this confident stance and continued rate hikes by the Feds. Enter ChatGPT. If you haven’t already heard waaaaay to much about chatGPT, it’s a smart artificial intelligence which is replacing jobs by the droves. And that’s exactly what Jerome Powell is looking to do:

This is the JOLTS jobs numbers which shows the number of open available jobs each month. We’re currently sitting around 10-11 million job openings every month in America.

Now, before the pandemic this number sat around 7.5 million jobs. Interestingly, while there are so many jobs available, the number of people making new claims on unemployment insurance every month has returned to pre-pandemic numbers:

While we’ve returned to pre-pandemic unemployment numbers there remains and additional 3-4 million jobs that are unfilled. There could then be a case that Jerome Powell would continue to raise rates since he’s just recently put an “emergency backstop” in place to protect the banks from failing, so by raising rates and tightening the economic landscape this could lead to companies increasing their layoffs which is fine in Jerome’s eyes cause he needs 3 or 4 million people to fill these open jobs.

Mess With the Bull, Get the Horns

MESS WITH THE BULL, GET THE HORNS

A case for the upside. As I mentioned earlier, I doubt the Fed’s are in a hurry to cause a financial crisis led by a housing crash. With that in mind, many feel (and rightly so) that if Powell continues to raise rates it would cause property foreclosures to skyrocket as homeowners walk away from their drowning mortgage payments. This is where a bullish case could be made that Powell has raised rates too far too fast (so fast in fact that it caused a banking crisis) so at the next rate meeting he’ll need to pivot from rate hikes to a hold or even a rate cut to relieve the pressure that many are feeling. A pivot in the Fed stance would most definitely result in a market rally, the difficulty however is that inflation is still inflated and the Fed’s recent spending spree could easily fan the flames again on the already elevated inflation numbers.

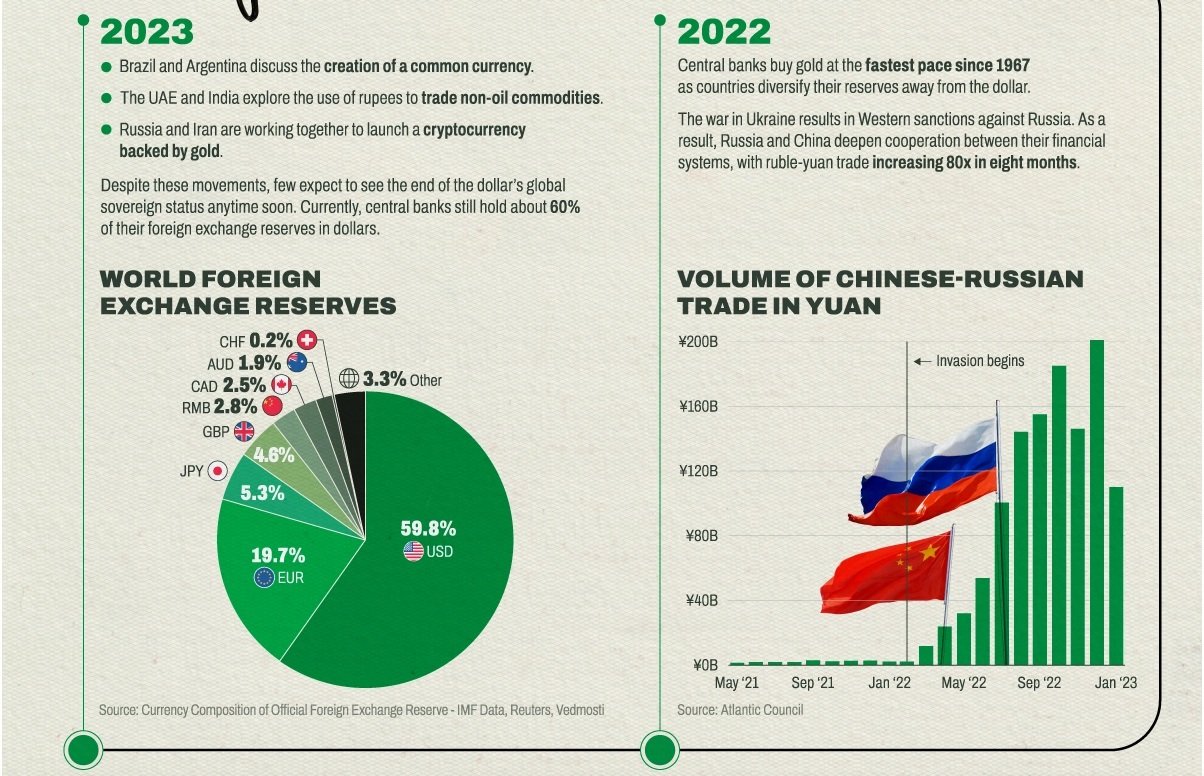

The other case to be made for a rally in the market is that other global superpowers are joining forces in an effort to dethrone the US dollar as the global reserve currency. Not to name names but these countries aren’t really winning any popularity votes (ahem China, cough cough Russia) but nonetheless as they make an effort to cut off trade partners with the US it gives way for Jerome Powell to reduce rates and by extension lower the cost of doing business (global trade) with America which would almost certainly lead to a rally in the markets.

What’s next? Barring any brash decision-making from the Feds (who I trust as far as I can throw) there is a very real possibility that we spend the remainder of 2023 held inside the outer bounds of the current range which would look something like this:

This is my first belief scenario for a couple of reasons. The first being that if you spend any time on Twitter at all right now there’s a lot of confident finite language, “get ready for the worst sell off ever” or “here we go, return to normal, new all time highs incoming”. Everyone seems to be convinced of the market going in one single definitive direction, and while the broad indexes aren’t designed to remain rangebound for an extended period of time, this continued sideways move would be the least expected by the majority of market participants. The other reason is that after big banks and institutions sent out negative returns on their annual statements in 2022, they’ll be looking to avoid a repeat of that 2 years in a row, so as long as the indexes finish at the upper end of this range they’ll show positive returns for the year.

The other possibility is something that I’ve talked about in the past and it’s a little more daunting. It looks something like this:

I don’t love to spend a lot of time thinking about a bad market but I’d rather obsess over it so that you don’t have to and so that we can make more informed decisions about how to protect clients investments. If the conditions of the economy are as bad as expected, there’s a chance that the market could rally up into this pink area and the thought of a return to “normal” could sink in causing a lot of retail investors to be buying and if you recall from my previous market updates, when someone buys, someone has to sell and who would be selling at this top? The real big banks and institutions which could result in a severe sell off.

I don’t know if you’ve see this before but this is one take on how a market sell off cycle occurs:

Where would you say we are if this graph was an accurate depiction of the current market?

How does your answer change if you see the chart of the S&P beside this graph?

It, unfortunately, feels like we could be standing on the edge of a greater sell-off. I know that can seem concerning for a lot of people but the key to remember is that this sort of thing would actually be the healthiest and most beneficial thing for the market (and most importantly, your investment portfolio) in the long run. It also becomes a lot less scary when your portfolio is protected to the downside. So I will be monitoring the market development very closely and am prepared to “pull the sails in” if necessary and make a move to cash and safer assets to protect your investments and preserve your capital.

This market recap has started to read a bit more like a short novel but that’s the current conditions right now. There are a lot of cross-currents of information and geopolitical storylines that are muddling the average investor outlook but rest assured that as your financial advisor, I am OBSESSED with this stuff so that you don’t have to be and I work hard to bring you the most honest truth about the markets so you can feel confident about the decisions being made regarding your financial goals and future so thank you for your continued support and I continue to look forward to serving you and your family’s wealth accumulation goals.

If you would like to book an appointment to review your personal portfolio or discuss your savings goals in more details, please send an email to Lane@LaneCuthbert.com to schedule a time.