Dog Days of Summer - Q2 Market Recap & Outlook for final half of 2023

60 second overview: After a market bottom in October 2022, the first half of 2023 was CRAZY GOOD…like record setting, best first half of the year EVER good. Despite banking crisis’, decades high interest rates, and a continued battle with inflation markets have rallied on and we were poised to capture that upside growth so returns have been good this first half of the year. However, looking forward we see many difficult obstacles ahead that should be cause for concern and with that in mind, we have adjusted portfolios again to a conservative position to lock in profits and preserve capital by avoiding potential losses that could come in the remainder of the year.

Let’s take a look at the current market conditions:

While the market bottomed out in October 2022 and started a recovery rally, Q1 2023 was pretty choppy sideways price action as the S&P 500 struggled to break above the 4,200 point mark. Q2 2023, however, saw a strong rally and break out to the upside:

So what caused the market to break out? Well, back in the early part of the year there was an anticipation that after central banks had raised rates aggressively, they would begin to pivot on their monetary policy stance by holding rates or even beginning to cut rates and easing economic conditions making it more likely for companies to thrive. Jerome Powell and the FOMC were forecasting their rate cuts to begin in June 2023, so to no ones surprise, when June rolled around the market broke out the upside as it awaited the Fed’s rate announcement.

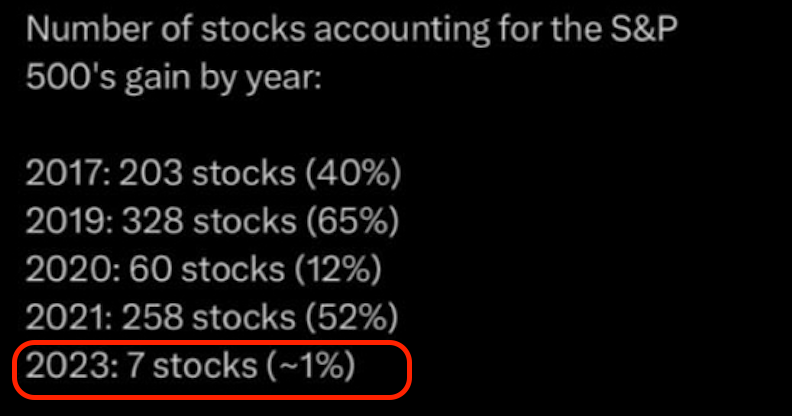

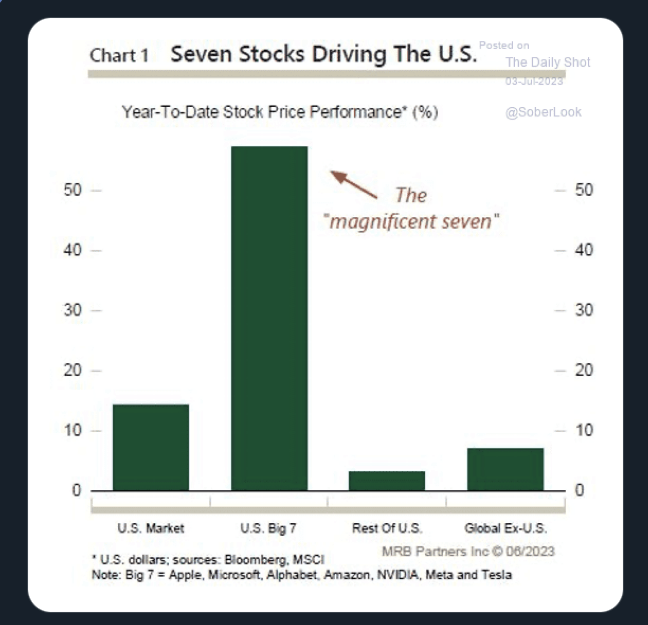

But while the broad indexes were breaking out and rallying to the upside, if you were to take a look under the surface at the individual performance of the companies that make up the S&P500 it told a startling different story to the “strong market” facade being portrayed. The S&P 500 represents the 500 largest companies in America, but during this period of market growth a joke was circling calling the market the S&P 7, because while the broad index was in positive numbers only a measly 7 big cap companies participated in that rally (their market cap [amount of influence on the broad indexes] just happened to be HUGE):

And of those 7 companies they all seemed to be focused on the future life-changing power of artificial intelligence. Now while I have no doubt that AI will have an influence on the future of the world, tools we use in every day life, and the work force I can say with certainty that the technology does not warrant the price action we saw from stock tickers like NVDA rallying 306%+ in 8 months.

So the question we have to ask ourselves now is: are we in a bull market or bear market?

Well before I give you the quick and easy answer it’s interesting to see how to investment industry views this question. The “technical” definition of a bull/bear market is a when an index moves 20% or more in a single direction. There’s a major problem with this definition of price movement. The first is, it leaves a lot of people waiting for a 20% rally or fall BEFORE they call a market bullish or bearish, meaning if someone was considering buying they’ve missed out on 20% of gains waiting for some market talking-head to give a green light that it’s time to buy, after the market has rallied a significant amount already (which by the way, actually increases the risk and decreases the probability of being a profitable investor). The other major issue with this working definition is that it is a lagging indicator. By the time a market has rallied or fallen by more than 20% there’s an increased chance that you’re coming late to the party and there’s a risk that the rally or drop will not continue much further without a reversal in price action

RECENCY BIAS

Recently I’ve become more attuned to something called ‘recency bias’ which states that: “[investors] believe that whatever the current market conditions are, will persist into the future'“. So basically, when things are good people believe they will continue to be good (ahem real estate market), and when things are bad they’ll never get better or improve. I’ve noticed how prevalent this mindset has become among retail investors, but it’s like that famous quote from Ricky Bobby: “if you ain’t first…you’re last.” In the markets, if you don’t have an edge on the competition and are making anticipatory trades, then you’ll be stuck at the mercy of those you beat you to it.

So who stands to gain from the “latecomers” in the market? The banks and institutions. Think about this for a moment, at the beginning of 2022 the market began selling off in fear that the Fed’s would raise interest rates and tighten economic market conditions, hurting businesses. The largest market participants (banks and institutions) prepared themselves to take advantage of the ‘future market conditions’ and shorted the market, and MAN did they profit! Then, the market bottomed in October and began to rally back. Now, did any of the talking heads advise investors to be aggressive and bullish at the bottom of the market? Nope not even a little bit! What about the 6 months that followed the market bottoming out? Again, there was pessimism EVERYWHERE:

Every excuse under the sun as to why the market was rallying but no one was eager to tell investors to take advantage. So isn’t ironic, now that the market happens to be back at the origin of where big banks and institutions likely placed their HUGE shorting order at the beginning of 2022, that all the talking heads want to tell everybody to be buying aggressively and are calling this a new “Bull market”:

But if the market is a zero sum game that would mean for every buyer, there’s a seller and if it’s a ‘new bull market’ who would want to sell if everyone should be buying this new growth opportunity…yep…you can already guess what I’m gonna say…BANKS AND INSTITUTIONS. Their orders are so MASSIVE that the only way they can get all of their orders filled (or as much as possible) is if they can get as many people huddled onto the other side of their trades as possible, so what better way to get everyone excited than by calling for a new bull market AFTER a huge rally? But look where the location of the S&P and Nasdaq are when these things are getting said:

So in an anticipatory move, at Lane Cuthbert Financial, we moved into an aggressive position in portfolios in May 2022 and we’ve seen good portfolio growth since then, capturing the last 8 months of rallies in the market, and now again in an anticipatory move to fight against recency bias and start preparing for future market conditions, let’s talk about the reasoning behind why we’ve moved back into a conservative position in portfolios (aside from purely the location of indexes on the price charts).

Interest rates, the Feds, and that pesky thing called inflation

By and far the greatest concern for markets right now is the current interest rate environment. Not only have rates been hiked too far too fast, but, it takes on average 18-24 months for fiscal policy changes to permeate the economy and the Feds began raising rates exactly 18 months ago. We’re only now about to begin feeling the effects of these changes on the economy as they filter to every level of society, beginning with real estate.

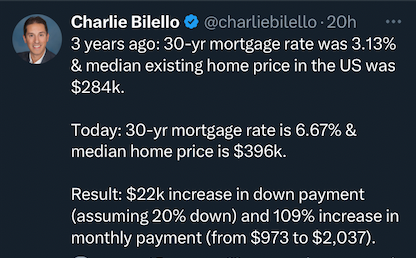

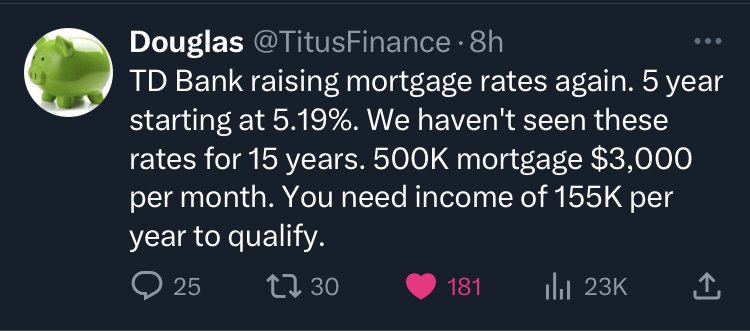

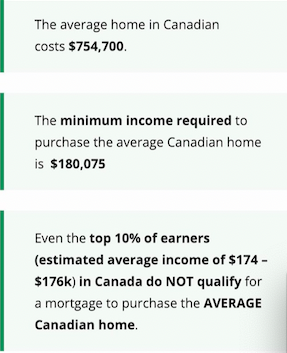

There is no doubt that home owners have felt the adverse effects of higher interest rates, particularly those who didn’t lock into a fixed rate mortgage when rates were cut to 0% during Covid. And now we’re seeing an incredible difficult environment for new home buyers trying to qualify at these interest rates:

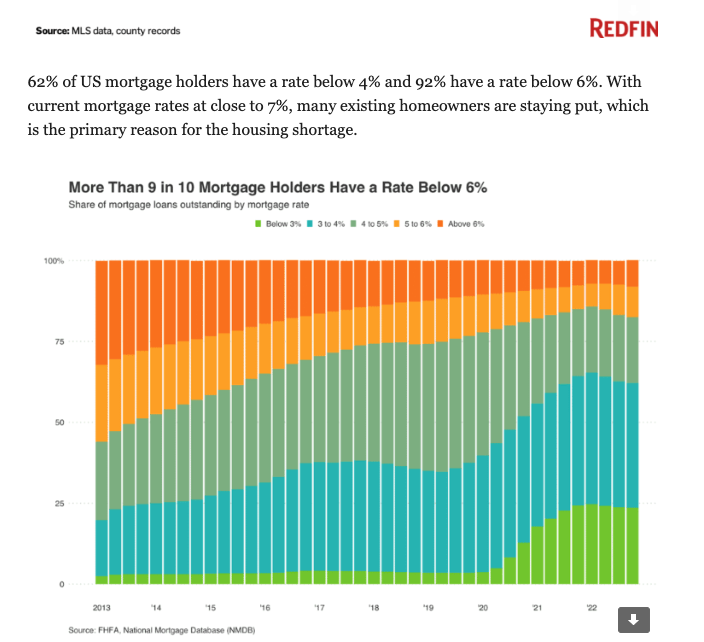

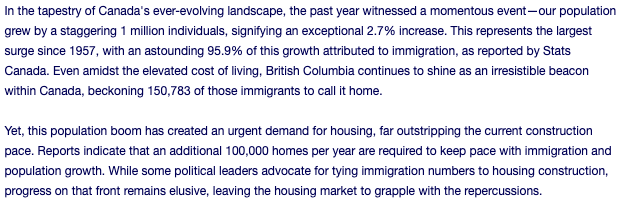

Despite the rise in interest rates, home prices have remained steady. While many media channels and realtors have attributed these strong prices to ‘demand’ buying from immigration it is far more likely that home prices have seen an imbalance between supply and demand because a lack of supply rather than an increase in demand. Anyone who locked in a fixed rate is unlikely to be motivated to sell their home before their term renewal at these astronomical increased rates so fewer homes are listed which has lead to more bidding on fewer homes and prices remain strong. Will that continue into the future? Well that’s where things get a little uglier.

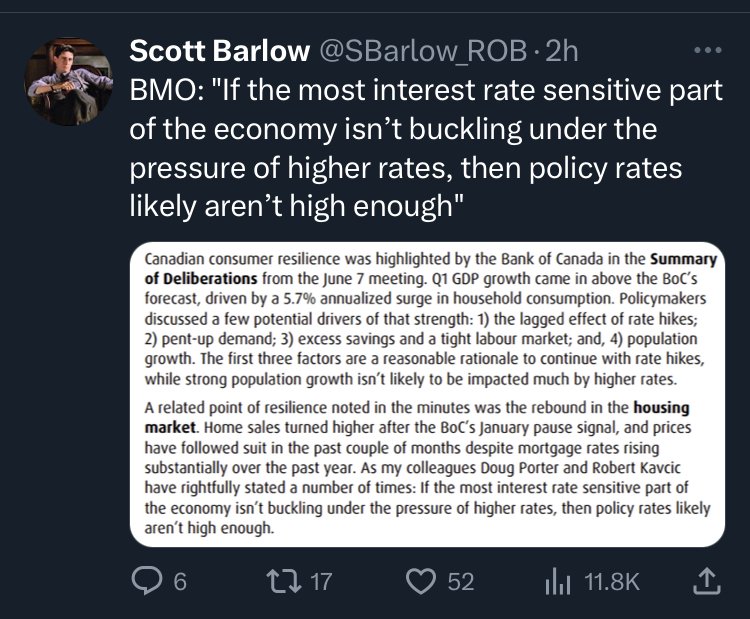

The original plan for the central banks and Feds was to raise rates hard and then begin pausing or cutting rates in June 2023. However when June rolled around the Feds changed their story. Jerome Powell went on a post rate announcement press conference to tell the media that his forecast of the market has changed and that the FOMC now has 80% voting in favour of 2 more rate hikes before the end of the year AND Powell doesn’t foresee cutting rates for at least 2 year. 2 YEARS! That’s a major change from Jerome Powell and unfortunately does begin to bleed into this mortgage timeline. If homeowners locked into a fixed rate mortgage in 2020, they likely went into a 25 or 30 year amortization with a 5 year term on their fixed rate, which means if we continue to raise rates and hold them elevated for the next 2 years we could see a major segment of homeowners be tossed into the deep end with mortgage renewal payments that are 45-75% higher than their current payments.

And if rates continue to rise, the lending environment will continue to get more restrictive making the number of qualified buyers significantly reduced, so not only will supply of homes potentially increase as more people cannot afford their mortgage payment but demand for those homes will also diminish creating a perfect storm for home prices to slide significantly.

Now, home prices are only one metric that Jerome Powell and the FOMC consider when making their interest rate decisions. One of the most prevelant considerations for the Feds is labour market conditions. The thinking being: when economic conditions are too restrictive then many major employers are forced to use their profits to pay for liabilities and will often resort to increasing their ‘bottom line’ by laying off employees (eerrrr Shopify we’re looking at you) if they are unable to increase their sales and profits. And right now, the labour market is strong. Unemployment remains at record lows with JOLTS job openings still above 10 million. So there’s lots of jobs available and people are working which paves the way to encourage central banks to continue to raise interest rates because they view these conditions as positive and that their interest rate hikes have not being too restrictive so they’ll keep pushing rates up to find where the economy starts to crack before pulling rates back. But these labour numbers are a bit misleading.

Since the cost of living has increased so dramatically, average consumers aren’t just faced with higher interest rates they’re also faced with the lingering effects of inflation and increased cost of living forcing many employees to work during their retirement or delay their retirement proportionately.

Speaking of cost of living…what’s going on with that pesky thing called inflation? You don’t have to look far to see every politician in every country breaking their arm to pat themselves on the back for being the one to “reduce inflation to multi-year lows” (and fail to mention that it went to record highs under their administration also), meanwhile, at the pump and grocery store it doesn’t feel like life has gotten any easier on the wallet and that’s because, it hasn’t.

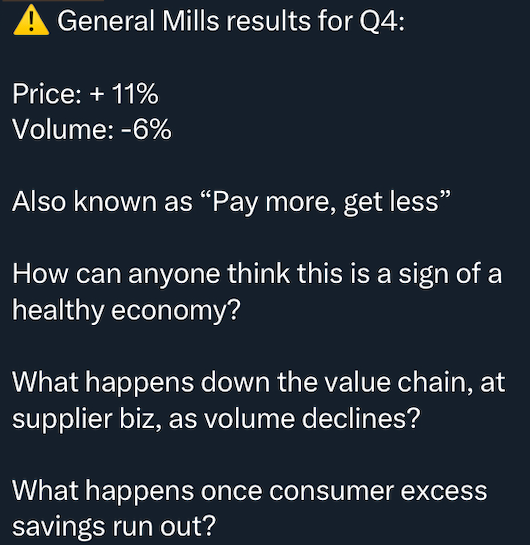

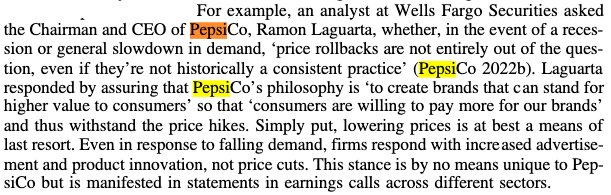

Inflation is the result of too much money in an economy, so raising interest rates is a very effective way of reducing the amount of money in the system. And the rise in rates has certainly resulted in lower inflation year over year (though it’s still higher than historical numbers). The problem we’ve run into is that while a small portion of inflation is the “sticky” kind that’s hard to get rid of, the continual high prices of goods is the direct result of price gouging consumers. The reality is that businesses are driven by profits so when they see an opportunity to make money, they take it. When inflation spiked many businesses noticed that consumers adjusted their lifestyle (or used credit) to continue purchasing goods at higher prices, so as inflation fell these businesses saw it as an opportunity to leave the price of their goods untouched and increase their profit margins knowing that their consumers are finding a way to adjust their lifestyles to continue purchasing their products.

So despite a reduction in inflation, many major brands have not cut prices and expect their consumers to continue justifying paying increased prices.

And the consumer industry is not the only one to be doing this, both crude oil and natural gas are prime examples. While barrels of crude oil are down -42.8% from the peak inflationary highs from June 2022 last year, the price at the pump is only down -16.75% compared to last summer. Meanwhile, natural gas futures at down -73.3% and average Fortis bills have INCREASED +22.5%. Without proper advocacy on behalf of consumers we are unfortunately being forced to continue paying for these products and services that are essential to our daily lives.

And as interest rates rise on variable rate mortgages, many homeowners/landlords are feeling the increased pressure on their monthly budget and are doing whatever they possibly can to pass expenses along to their renters causing rents to skyrocket in an attempt to continue to cover their monthly mortgage payments. It’s not quite the same as consumer price gouging but has a very similar effect on monthly financial burdens, and despite some of the safeguards in place to protect renters from these kinds of increases, landlords are still finding loopholes to exploit and dramatically increasing costs.

So how does all this affect our outlook for the future? Well the major concern of these price increases across so many different sectors is that back in 2022 and in January 2023 when central banks were talking about cutting rates in June 2023, many Canadian consumers believed that they needed to just “weather the storm” for 6 months and then prices would start dropping. So for those that were unable to increase their income during this time, they turned to short term credit to cover their expenses…credit card debt (which now has interest rates at 25.99% by the way) which has now crossed above $1 trillion dollars for the first time EVER. That’s $259,900,000,000 a year in interest for those that care.

And you know what, some big businesses saw this increased demand for short term credit and capitalized on it by starting their own credit card companies…ahem, APPLE. They didn’t even make people pre-qualify. They just had an INSTANT approval process and started handing out money. Talk about predatory practice, sheeesh! But even APPLE can see the concerning risk of central banks holding rates higher for a longer period of time and the risk it posses to a company like Apple if their debt consumers are unable to pay back their loans. So they’ve been transferring that risk away to banks at a premium. They created a debt burden and then got paid to give it to someone else. Yuck!

But consumers aren’t the only one with a debt problem on their hands. According to an S&P Global Ratings Research analyst, approximately $11 trillion dollars in corporate debt is scheduled to mature globally from the end of 2021 through to the end of 2026 into this high interest rate environment increasing the risk of a credit default situation that is irreparable, regardless of central banks printing money. Not to mention the fact that student loan debt repayments in the States are set to resume September 1, 2023. It’s the culmination of all these different sources of debt that lead us to believe we could see a credit crisis on our hands in the second half of this year.

Outlook for remainder of the year

Have I been doomy and gloomy enough for you? I hope not but in all seriousness, this is the stuff that keeps me up a night and I’m reminded again of the importance that capital preservation plays in your long term investment management. Gains are great but by avoiding major losses we can grow portfolios, savings, and retirements faster instead of needing huge gains to replace losses and wasting time invested that could be used to improve your portfolio.

As for the remainder of the year, here’s what I believe we can expect to see. If you recall my investor outlook newsletter from Q1 2023 I said we could expect price action to look like this:

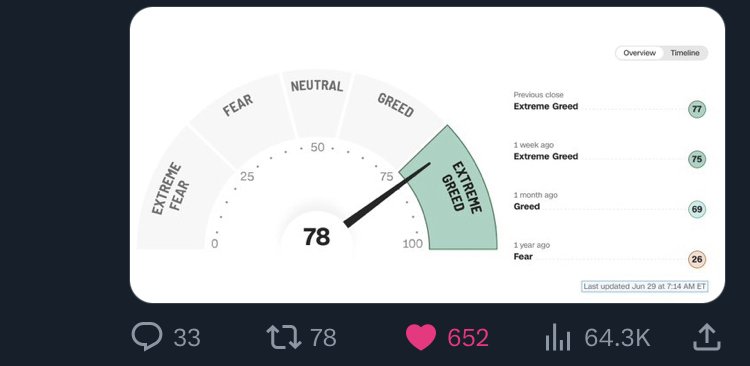

With a little less draw down than anticipated, that is basically exactly what happened. Now that price action has taken us back to the origin of the sell off from 2022, coupled with Jerome Powell and central banks claims to continue raising rates and holding higher-for-longer than expected, and extreme greed in the market (be FEARFUL when others are GREEDY and be GREEDY when others are FEARFUL), I am anticipating that we will see a strong bought of selling to close out the year:

Now before you go marking me as a dooms day prepper, this sell off I’ve drawn on the chart is a conservative estimate of a potential draw down in the markets. As painful as it would be, it’s healthy for the market to have draw downs and would create greater long term strength in the markets.

I also showed this picture in the last investor newsletter and it’s more prominent now than ever. As greed takes over and a “return to normal” (new bull market) mindset comes in, a sell-off in the market has the potential to gain momentum to the downside and when these things happen the market will return to the ‘mean or median’. If a sell-off did gain momentum and fell further than expected here’s an idea of what that could look like:

I don’t like to think this way, but the boy scouts have a saying that I think is worth considering at a time like this and that is to “expect the best, and prepare for the worst”. With that in mind, higher interest rates isn’t all a bad thing. The last time we moved into a conservative position in portfolios overnight rates were at 0.25% so conservative savings investment options were very limited and conservative returns were hard to achieve, but now, with Canada’s overnight rate at 4.75% and likely to be above 5% by mid July, our move to a conservative position in portfolios should yield strong returns with savings rates being so high right now.

Short term GIC rates have also increased as a great, safe, savings alternative for those investors looking for guaranteed returns with zero risk and an expected return. Here’s just an idea of what the current rates look like:

You can see that even banks are pricing in and expecting high rates for the next year and half at least before rates taper off in the midterm GIC’s.

Another great opportunity these markets have presented are for retirees looking for a guaranteed income stream in retirement through the use of annuities. Annuities were very popular in the early 2000’s when rates were high enough to produce a great rate of return for retirees as a portion of their retirement portfolio to offer guaranteed preset amounts of income on a monthly basis for a set number of years or for life. Unfortunately, we haven’t been able to benefit from the security that annuities offer retirees for almost 15 years! But with rates on the rise the opportunity to lock in a portion of your portfolio in guaranteed returns for life is looking attractive again.

And it’s important that we be strategic and look for investing opportunities to put your money to work, earning a return, because again, as something we haven’t had to think about for almost 16 years, inflation must be considered at eroding away purchasing power and diminishing future returns.

The need to be invested is more important now than ever to combat inflation.

And one of the ways that we’ve been taking advantage of these market conditions is that several clients over the past few years have been able to purchase rental properties in Calgary. And that’s good news because on top of their properties being cashflow positive and generating income on a monthly basis, they’ve seen greater than a 10% increase on their property values as Calgary continues to draw young people and families to their city with lower cost of living and the opportunity to be homeowners without being priced out of the market, which has offered a great return on investment for those investors that acted on that strategic advice.

And here at home in BC these higher rates might mean a good thing for those looking to purchase in the near future, BUT, don’t let FOMO cloud your decision making. It can be tempting to feel like you’re going to miss out and rush into buying a property but consider this for a second:

By waiting and letting interest rates reduce home prices there’s a chance that you could save a whopping amount of money on the purchase price but more importantly by waiting and buying after rates come back down you’ll also save a crazy amount in interest costs. In this example above it’s only a 10% decrease in home prices which would save you $100,000 in purchase price and then an interest rate at 4% (which is still double the historic average) instead of the current 6%, you’d save another $100,000 in interest payments in the first 5 years. Dang! And the cherry on top?!? For the first time since 2007 we could see a sizeable drop in home prices to make this possible as interest rates get to levels we haven’t seen in 2 decades. Hang in there! You can do it (and it’ll be worth it)!

So whether it’s through guaranteed return accounts like GIC’s, or adding a level of confidence to your retirement with annuities, or taking a chance and looking for higher risk higher reward speculative investing opportunities, the financial landscape is changing again in front of our eyes and everyone’s personal financial situation looks different so if you’re being kept up at night thinking about your financial future with these current conditions or are interested in finding out how you can take advantage of these rare market investing opportunities, schedule an appointment today and we can do some out of the box thinking to see how you can take advantage of these conditions to maximize your returns and your financial future. Remember, as always, I am OBSESSED with this stuff so that you don’t have to be.

If you would like to book an appointment to review your personal portfolio or discuss your savings goals in more details, please send an email to Lane@LaneCuthbert.com to schedule a time.